Are You Ready to Leave the Military? Here are 8 Things to Consider

by Rebecca Alwine - November 4th, 2022

You’ve decided you’re ready to leave the military. Whether retiring after 30 years or fulfilling that initial enlistment, this is often intimidating. You’ve spent years learning and living this lifestyle, and now you’re faced with a new one.

Separating from the military gives you freedom in some ways, but also brings with it more decisions that are entirely up to you. You’ll decide where you live, and you’ll also need to decide on health insurance. You’ll have your discharge paperwork, and you’ll need to become familiar with VA benefits. Here are 8 things to check in on when you are preparing to leave the military.

3 Things to do before you leave the military

Submit your paperwork

At a minimum, you must give your branch six months' notice before retiring. The earlier you can do it, the better, but that window is branch dependent. If you are leaving the military and not retiring, you may have shorter or longer, depending on how you’re leaving. Make sure you talk to your command and retention about the process.

Schedule medical appointments

Medical appointments should be made so you can make sure your records are up to date when you file for VA disability benefits. Try to get that final physical at least six months out from your separation date (not terminal leave date) so you can have everything addressed.

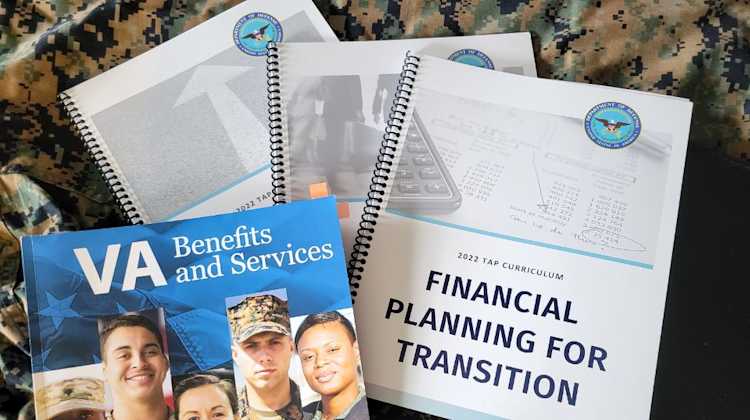

Attend Transition Assistance Program classes

Attending Transition Assistant Program classes is a requirement, so don’t think about blowing it off completely. Your spouse can also attend too, as many topics that are discussed are beneficial for them as well. The course covers VA benefits, resumes, job searches, and much more. You are able to attend the course multiple times if you’d like and there is space available.

3 Post-Military Decisions to Make

Healthcare Coverage Options

An important decision separating service members face is health insurance. When retiring, you can sign your family up for Tricare for Retirees. This covers you, your spouse, and children up to age 21, or age 23 if they are attending college.

Those separating from service who aren’t eligible for Tricare have a few options. The Transitional Assistance Management Program (TAMP) offers 180 days of transitional health coverage. If that isn’t long enough, you can also use the Continued Health Care Benefit Program for an additional 18 to 36 months of coverage.

If you leave the military and continue with a new employer, you can use their health insurance or any other plan offered through the marketplace.

Survivor Benefit Plan Options

The Survivor Benefit Plan (SBP) is a form of income insurance for a surviving spouse that will pay up to 55% of retired pay to the beneficiary. Service members are enrolled in this program unless their spouse elects to refuse it. The spouse must be part of that decision. There will be 360 premium payments over 30 years, of 7% of the monthly retired income. There is a one-time option to drop this coverage in year two of the election.

Life Insurance Coverage

After you’ve figured out your health insurance, it’s time to look at life insurance coverage. When active duty, the service member was automatically enrolled in the Servicemember’s Group Life Insurance (SGLI). That $400,000 coverage continues for 120 days after you leave active duty. Any family coverage under FSGLI also continues for 120 days.

Many service members opt for an insurance policy from Veteran Group Life Insurance (VGLI), which has guaranteed coverage. You cannot be turned down. There are no health exams and no increases in premiums due to tobacco use. If you pay the premium, you will be covered.

But VGLI does come with a downside, and that is the increasing premiums – which are based on age. This becomes a problem for many retirees as they age. Whatever your decision, try to make it as early as possible so you can lock in the lowest rate.

Learn About Your VA Disability Rating

The disability rating you receive from the VA serves as a gateway to most VA benefits, federal employment preferences, and state benefits. The higher the rating, the more benefits are available to you and your family. A 30% or higher disability rating factors in your dependents, so your benefits increase significantly.

The Survivors’ and Dependents’ Educational Assistance (DEA) program offers education and training opportunities to all eligible dependents -- spouses and children -- of Veterans who are 100% permanently and totally disabled and who are 100% Individual Unemployable.

Why Your VA Rating is Important

Your VA Disability Rating will impact several things in your post-military life. For example, your health care provider will ask for it, and the state where you pay taxes will require your rating to offer tax credits or relief. Some states don’t tax military retirement and some offer a lower tax rate based on your disability rating.

Depending on the percentage, a state may waive a percentage of your property or vehicle tax. There are also educational benefits based on disability ratings that vary from state to state. A 90-100% permanent disability directly caused by the Veteran’s involvement in military operations allows dependents 36 months of tuition in several states.

Schedule an appointment with a Veteran’s Service Organization such as Disabled American Veterans. They are trained to help and can assist you in submitting your application.

Double Check Your DD214

Make an appointment with a retirement specialist for an administrative review of your DD Form 214 -- your Discharge Papers and Separation Documents. You want to make sure the information on your DD214 is accurate in the characterization of your service. Check to make sure it correctly lists your length of service, your combat awards, etc. The Veterans Administration and the state will use this document to verify your veteran status.

Decide where to live

There are many factors to consider when deciding where to live after leaving the military. Some people choose to move back home to be near family, others remain in the area of their final duty station, and still others choose a completely new state. PCSgrades has many helpful articles about choosing where to live after military service:

Top 10 Best Places for Military Retirees 6 Things to Know About Choosing Where to Live After Military Retirement Choosing a Forever Home After Military Retirement Buying a Home After Military Retirement 5 Medical Factors for Your Forever Home Location Where to Retire if Your Kid Joins the Military Your Last PCS: Where to Retire After Military Service

When leaving the military, the government covers one more military move to your home of record. You can read details about calculating that final PCS move here.

Separating from the military comes with a lot of decisions to make, along with a huge lifestyle change. You and your family can prepare for this by starting early, doing your research, and using the resources available to you.