Why Service Members (and Spouses) Should Attend TAP Retirement Seminars

by Lizann Lightfoot - July 22nd, 2022

My husband is now one year from military retirement! Wow, after two decades of his military service, we are finally ready for the next chapter of our lives. We are both excited--but also a bit overwhelmed--by all that will happen in the next few months. Retirement brings a new level of freedom that our family has never experienced: we can live where we want, stay in schools for more than three years, and go on vacation whenever we plan one!

However, leaving the military also takes away several safety nets that our family has become used to for many years, and we now have to make our own decisions about major life choices like buying a house, getting a civilian job, navigating health insurance plans, having life insurance and retirement savings, and planning a family budget that works for our new lifestyle.

It’s a LOT to process, and I have so many questions.

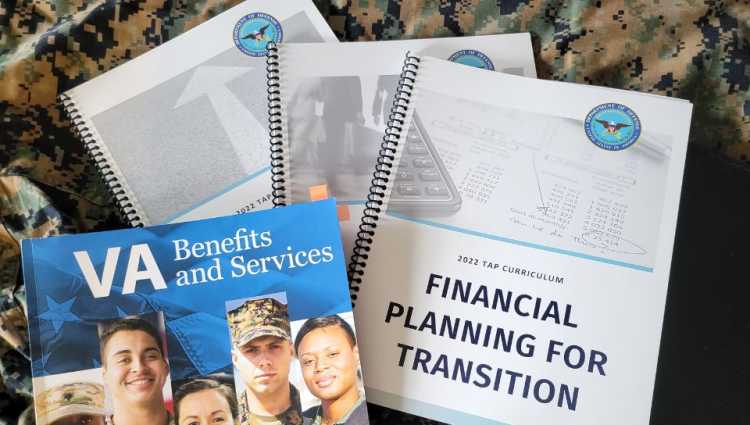

So when my Marine told me there were open spaces at his TAP retirement seminar on base, I jumped at the opportunity to attend. We spent several days together in a classroom absorbing all the information we could about our retirement options. And it gave us a great foundation to make informed decisions about our future together.

Keep reading to learn what is in the TAP seminar, who can attend, and when to schedule yours!

What is the TAP retirement briefing?

TAP stands for the Transition Assistance Program, which is used by every branch except the Marine Corps. Marines attend TRP (Transition Readiness Program). TAP is usually a seminar offered on your military base that can last two or three business days. During a TAP seminar, you will attend briefs with information from the Department of Veterans Affairs (VA), learn about DoD resources, and gain career insights from the Department of Labor.

For most branches, there are several days of group classes, plus some optional career and resume-writing tracks, followed by one-on-one counseling sessions. The TAP Capstone is scheduled for a future date, when the service member demonstrates that they have completed their transition training as required by the DoD Career Readiness Standards.

Service members and their spouses are invited to attend a TAP briefing to help them prepare for the career and financial decisions they will face when leaving the military.

When should I attend a TAP seminar?

Service members are required to attend a Transition Assistance Program (TAP) seminar before retiring from the military or leaving military service. Ideally, they should attend TAP at least one year prior to their final date of active service.

However, many service members recommend taking the seminar more than once. You can attend two years before your final service date to get a broad understanding of the choices you will have to make and the options available to you. Then you can attend again in your final year of service to get a reminder about all those decisions and apply them to your specific timeline.

The Capstone must be completed at least 90 days prior to the service member’s final date of military service.

What will we learn in a TAP retirement seminar?

TAP is a series of classes that are a classic example of information overload. In a group setting, you’ll experience hours of PowerPoint presentations and hundreds of pages of material from official instruction booklets. It’s definitely helpful to take notes on what you learn, so you can research it and think it through after you go home. You may also want to bring a laptop to visit all the website resources as they are discussed.

Here are some of the topics covered in a TAP class. Spouses are invited (but not required) to attend any of these sessions with their service member.

Finances after the Military

Your paycheck changes a lot after you leave the military! You’ll discuss how to translate military active duty pay to a civilian equivalent, and methods for calculating your family’s retirement and disability income. Because each state has different rules about taxing military retirement or disability pay, your retirement package will stretch a lot further in some places than others.

Plus, you’ll also learn about resources to compare the cost of living in different states. An $80,000 income in one state might be a much more comfortable lifestyle than it would in another state, due to the cost of housing, groceries, gas, etc.

Still deciding where to live after retirement? Read more here about choosing a retirement location.

Health Insurance Options

During military service, your family has always been covered under TRICARE. Retiring service members and their family can continue to use TRICARE Prime or Select options, but they will pay an annual premium and must enroll within 90 days of the retirement date. You may also have health insurance coverage from your new employer.

Service members who are separating but not retiring will not be eligible for TRICARE coverage, and will need to enroll in a new plan, preferably through your next employer.

Life Insurance and the Survivor Benefit Plan

During active duty, the service member was automatically enrolled in a life insurance plan (SGLI, or Servicemember Group Life Insurance), with payments subtracted from each paycheck. At retirement, they can roll that coverage over to VGLI (Veterans Group Life Insurance) where they will be automatically accepted on the plan without a health exam if they apply within 240 days of active duty.

There are numerous life insurance programs out there, with prices varying depending on the amount of coverage, the length of the term, and the age or overall health of the applicant. Do your research to compare what works best for your family.

The Survivor Benefit Plan (SBP) allows the surviving spouse to continue to receive a portion of the service member’s retirement pay after the service member’s death. Think of it as a retirement plan for the spouse who constantly moved and started over at a new job at each duty station, so they didn’t have the opportunity to build up a 401K with one employer. By deducting a monthly fee from the service member’s retirement pay now (up to 6.5%) for up to 30 years and age 70, the spouse will receive a monthly sum after the service member’s death--up to 55% of the retirement pay. The amount paid out is COLA-protected, so it will increase as retirement pay increases.

Military families do not have to enroll in the SBP. Obviously, if the spouse is significantly older than the service member, or if there are better ways to invest those funds now, then it may not be a worthwhile plan for you. However, if the service member wants to receive anything less than the full SBP coverage, the spouse must sign and notarize a document acknowledging that they are opting out of this benefit.

VA claims and benefits

One full day of TAP will focus on the VA medical claims process and other VA benefits. All veterans will be eligible for some VA services and programs after they leave military service, but the biggest one everyone has questions about is the disability compensation.

VA disability claims can be filed in various ways, before or after leaving military service. Service members can apply for their initial rating 180 days before their retirement date. Unfortunately, it is difficult to accurately predict a service member’s disability rating before their health scan. So even if you expect a high rating, be sure to base your post-retirement budget on the retirement pay alone--not the disability pay--so you can live comfortably with any rating.

You can read more info here about veterans planning for retirement.

Education and career options

The TAP seminar will discuss numerous opportunities for the service member’s next step. Whether you are planning to pursue higher education, continue in your military career field, or pursue an entirely new career path, there are many benefits available.

You will discuss the GI Bill, and how to use it for your own education or transfer it to a family member. Service members can meet with a career professional for assistance in writing a resume, or to learn strategies in translating military skills into civilian lingo. There are also career development tracts to help veteran entrepreneurs interested in starting a business after military service. Depending on your TAP format, these sessions are optional, and they are less relevant for the spouse. So choose the tract or training that best fits your professional plans.

Whether you are years away from military retirement, or--like us--can see it just around the corner, then you will benefit from the resources presented at the TAP seminar on your base.