Webinar: Education Savings for Military Families

by Lizann Lightfoot - June 3rd, 2022

Our Guests: Paul Perez and Derek Ketel of Victory Capital

Paul: Good day everyone, my name is Paul Perez. I served 25 years in the United States Army and retired as a Master Sergeant. I am currently a Supervisor of a Mutual Fund Service Team for the Direct Investor Business with Victory Capital and I have been in the financial services industry since my retirement, so about 5 years now. Trust me when I say, I have been in your shoes and am thrilled to be talking to this group today on planning for education.

Derek: And, my name is Derek Ketel, I am Head of Sales for the Direct Investor Business at Victory Capital. I started my financial services career 21 years ago as a financial advisor at Morgan Stanley. As Paul mentioned, today we’re going to speak with you about planning for education and why it’s important.

What is Victory Capital, and how do they help military families?

Derek: Victory Capital is a global investment management firm that offers products and services designed to help people like you achieve their financial goals, whether that’s buying a house, building a retirement nest egg or saving for a loved one’s education. We offer a variety of different investment products, including mutual funds, ETFs, a 529 education savings plan and many others. As of March 31, 2022, we had approximately $178 billion in assets under management, and we are headquartered in San Antonio, TX, with offices all across the U.S.

We all know that PCSing and other military life expenses can really drain the budget of a military family. Is it realistic for military families to save enough for college?

Paul: I think we can agree, those of you who are joining in today’s webinar care about education – either your own or a loved one’s – and we’d like to help you plan for that.

PCSing is a fact of military life – the better you plan for it, the more successful it can be. The military has a plan in place to help with your move.

That’s not always the case when it comes to saving for education. Many military families know the importance but are unsure of where to turn for help. With four kids, all within 10 years of each other, I was looking for all the advice I could get.

So, our objective today is to discuss with you some of the opportunities available to help you save for education and to provide the information necessary to help you be better prepared.

One important takeaway from today’s conversation is that your education savings plan should have long-term benefits and real portability. No matter where your next change of duty station takes you.

Why is it important for our viewers to save for education?

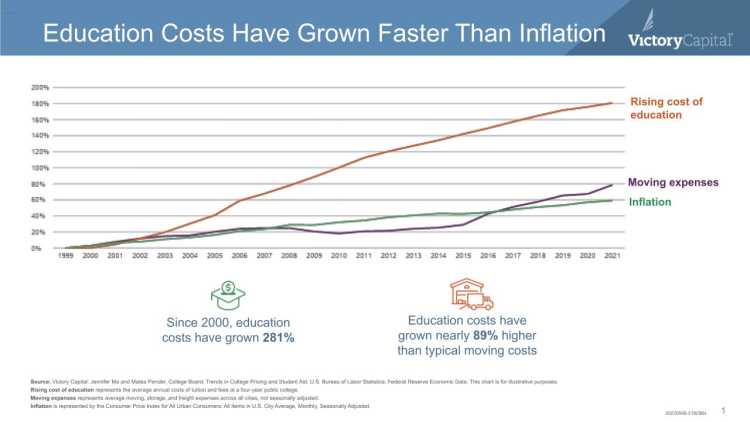

Derek: Saving for college -- just like saving for retirement – is generally a long-term goal, so starting as soon as possible is key, particularly given rising costs and the impact of inflation.

We’ve put together this visual, which I think really highlights how much education costs have grown over time.

Let’s put this into perspective. Today, students attending a 4-year public college – think state university here – will spend almost $23,000 on tuition & fees and room & board. That’s the national average.

Now this number doesn’t include any of the other essential costs of college, like books and supplies. Tack on an additional $1,240 annually for those.

It also doesn’t consider incidental costs, like transportation, tutoring, or entertainment. Right now, those average another $3,400 a year for the average student.

So, all told, a year at a public college currently can cost more than $27,600 a year. That’s more than $110,000 for four years.

Now bear in mind that this $110,000 is the average. Some public universities are going to be more expensive than that while others might be less.

We’re not trying to alarm our listeners, but what we are trying to do is really stress the importance of planning ahead.

OK, you’ve convinced me that college is expensive and requires families to plan ahead! What are some options for saving for education?

Paul: If you take only one message away from our conversation today, it’s that you have choices.

There are a number of opportunities available to help you pay for education and we’ll start with programs that are available exclusively to service members.

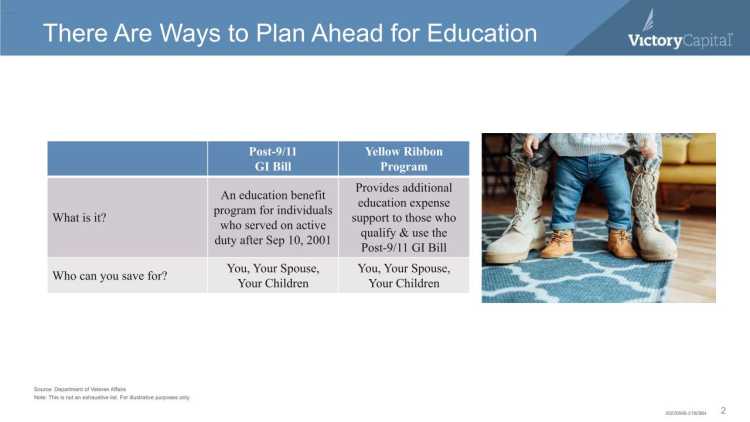

The Post- 9/11 GI Bill

The Post- 9/11 GI Bill is an education benefit program for individuals who served on active duty after September 10, 2001.

It pays for up to 36 months of tuition and fees at public in-state schools, private schools, schools overseas, and domestic schools out-of-state.

Those 36 months don’t have to be consecutive either. A standard university calendar is 9 months, not including summers. That means your Post 9/11 GI Bill should cover you for four years of education.

You can take more than four years to complete your study. But the benefit won’t pay for more than 36 months of tuition and fees.

The current benefit totals up to $26,381.37 per academic year and includes allowances for housing, books, and supplies.

You can transfer benefits to your spouse or your children, but you must apply to transfer benefits while you’re still on active duty or in the Selective Reserve, and you may have to agree to serve some additional years (up to four) when transferring benefits.

Yellow Ribbon Program

Now, if you, your spouse or your children attend a school that’s more expensive than what the Post-9/11 Bill covers, the Yellow Ribbon Program provides additional support.

Again, there are a number of eligibility requirements to be able to use the Yellow Ribbon Program.

First, you must qualify for the Post-9/11 GI Bill at the 100% benefit level and one of the following must apply to you:

You must have served at least 36 months on active duty and were honorably discharged

You received a Purple Heart on or after September 11, 2001, and were honorably discharged after any length of service

You served at least 30 continuous days on or after September 11, 2001, and were discharged or released from active duty because of a service-connected disability

You’re a dependent child using transferred benefits

You have a Fry Scholarship – which is only available to the children or surviving spouse of a service member who died in the line of duty

Also, you can only use the Yellow Ribbon Program at schools that are approved by the VA.

There are some challenges with using the GI Bill that we want to share:

The amount of available funds is limited. The benefit is a set amount. You cannot add to it like it’s a savings plan.

The benefit doesn’t grow over time.

Transferability is limited compared to some of the other programs available.

Now there are other types of education savings plans that can complement your military benefits, and they are open to both service members and civilians. Let’s talk about those…

What are the college savings plans available to military spouses, children, or dependents?

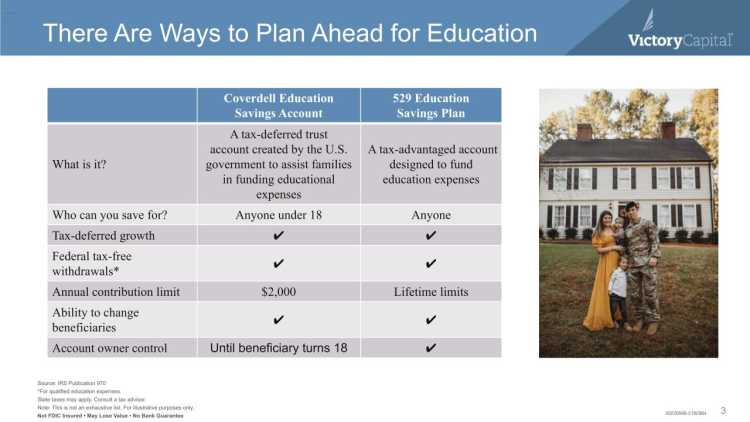

Coverdell Education Savings Account

Derek: Formerly known as an Education IRA, the Coverdell Education Savings Account – or ESA – is a “qualified” savings account created to help people save for education. And you can set one up for almost anyone.

Coverdell’s can only be established for beneficiaries who are younger than 18 years old. There is an exception for beneficiaries with special needs. So, as a practical matter, you can’t set up one for yourself.

The term qualified means that it comes with a couple tax benefits. But tax deductibility of contributions is not one of them.

The main tax benefit of an ESA is that earnings on the investments in the account are not taxed by the federal government, as long as they are used for qualified education expenses, bear in mind that state taxes may apply depending on where you live.

That’s why historically the Coverdell has been referred to as an Education IRA. And to be sure, there are some similarities to your Traditional IRA.

For example, contributions you make to an ESA are limited. You can only contribute $2,000 annually. But contribution limits are based on your income. Make more than a set amount and that $2,000 gets reduced. The more you make, the greater the reduction until at a certain point you are completely ineligible and just cannot establish an ESA.

For married couples filing jointly, $190,000 is the income level at which contribution limits begin. And at $220,000 you and your spouse are ineligible to contribute.

However, there is no restriction on who can contribute to an ESA. But the same contribution and income limits apply. A given ESA can never receive more than $2,000 in contributions in any one year – no matter who or how many contribute to it.

Now, in addition to the tax deferral they offer, ESA’s have another tax benefit. Withdrawals are not taxed when used for “qualified education expenses.”

Typically, qualified expenses are limited to things like tuition and fees and anything else required by a school to enroll or attend. So, that could include books and supplies and things like computer equipment and software.

You can use an ESA to pay for room and board – especially during elementary, middle (junior high), and high school. Think boarding school here. But there are some limitations for college students.

Other expenses like tutoring, transportation, school uniforms, and some extracurricular activities may also qualify.

Notably, you can use an ESA to pay for qualifying education expenses for K through 12. And for qualified expenses when your children attend college.

Now, whatever funds are in a Coverdell ESA when the beneficiary turns 18 become theirs – even if they don’t go to college. They can spend the money on anything. But the earnings portion of those withdrawals become taxable income and subject to a penalty if funds aren’t used to pay qualified education expenses.

I’m curious to hear more about the 529 Education Savings Plan--because that is the one we are currently using for our children.

Qualified Tuition Plans

Derek: A Qualified Tuition – or 529 Education Savings Plan Account – is another education savings account with tax benefits.

529 Plans are sponsored and administered by states and some colleges. And anyone can open one for anyone else or for themselves. And that’s an important distinction of the 529 Plan. You can open one for:

Your children

Your spouse

Yourself

Your grandkids

Your nieces and nephews

Your friends’ children

Heck, your neighbors’ children!

It doesn’t matter. Also, age doesn’t matter, while it does with a Coverdell ESA.

But, just like an ESA, contributions to a 529 Plan account are not deductible for federal income tax purposes. However, in some states using that state’s plan, contributions may be deductible on their state tax returns.

One of the other key benefits of a 529 Plan account is that there really are no annual contribution limits. You – or anyone else – can contribute as much as you like to a 529 Plan account every year. Gift taxes may apply to 529 plan contributions over a certain amount. Consult a tax advisor regarding potential gift tax implications.

But every state has lifetime limits, and those limits can be significant. Lifetime contribution limits range anywhere from about $200,000 to about $500,000.

Now, bear in mind that earnings on the investments in the 529 are not subject to federal income tax. Neither are withdrawals used to pay qualified education expenses. Again, these are the federal tax rules and not all states follow those rules. So, the earnings portion of withdrawals in some states might be subject to state income tax.

A 529 Plan account can also be used to pay for K through 12 tuition and fees and any expense required by a school to enroll or attend. But, the list of what’s qualified is a little more narrow than with an ESA.

And, there can be state tax implications when 529s are used for K-12 expenses. So, while the categories may seem to be fewer, the actual list of what you can use the money for is still potentially very broad.

For example, you can use funds in a 529 Plan account to pay up to $10,000 in student loan debt. You can’t do that with any of the other programs we’ve discussed so far.

And one of the other benefits of most 529 Plan accounts is that the sponsoring states and colleges often make several investment options available to account holders. So, a 529 Plan lets you allocate holdings to suit your specific risk tolerances and goals.

It’s also important to know that if the beneficiary decides that college isn’t right for him or her, then the money can also be used for lots of different types of career training or vocational schools.

The person who establishes the account owns it and makes all the decisions – even after the named beneficiary reaches 18.

So, if one child doesn’t go to college, but his or her sibling does, then you can simply name a new beneficiary and use the money for his or her education. And your ability to name successively new beneficiaries means that you could ultimately name yourself and use the money to go to Helicopter Pilot School if you wanted.

As long as a school is part of the federal student aid program, you can use a 529 plan account to pay tuition.

In the end, any money remaining in the account eventually has to come out. The earnings in the account become taxable if withdrawals don’t pay qualified education expenses, or you can simply name a new beneficiary – even if they aren’t related to you.

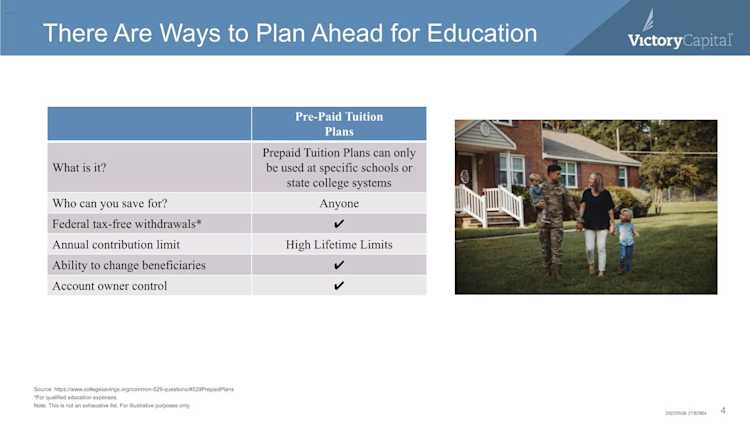

There is another type of 529 Plan, called a Prepaid Tuition Plan.

Prepaid Tuition Plans can only be used at specific schools or state college systems. And they can only be used to pay tuition – there are no other qualified expenses that can be paid out of them.

But they do allow you– as their name implies – to prepay tuition today and use those purchased credits somewhere in the future to satisfy tuition expenses dollar-for-dollar no matter how much the cost of a unit or credit increases down the road.

In many military families, the service member and spouse could be paying for degree programs at almost the same time they are paying for their children. So who can you save for under these plans?

Paul: Consider this all-too-real scenario: You PCS to a new duty station. Your spouse finds an awesome new job. But the job requires that additional certifications are obtained. With the right type of education savings plan, the cost of getting those certifications could potentially be covered.

And that’s the main point – it has to be the right type of plan. So, it’s important to know what types of plans can help pay for what types of education options.

Comparison of the Savings Account Options

We’ve put together a comparison chart of these savings options for your reference that we will make available on our website, as well as a chart that compares the expenses that qualify for each option.

What is your advice for someone who has multiple children? How much would someone need to save? Is there a resource where you can calculate this?

Derek: Like we discussed earlier, the cost of tuition, room and board and other expenses can reach more than $100,000 for a 4-year degree at a state college. That’s a substantial sum. How do you get there? The same way you walk 1,000 miles, one step at a time. The sooner you can start, the more time you have to reach your destination. As an investor, time is on your side. The earlier you can start saving, the more time you have to accumulate, and the more time those accumulations have to potentially earn a return for you.

Figure out your budget and stick to it. Use windfalls, like pay increases, bonuses, or income tax refunds to augment your regular savings plan. Treat your contributions to your kids’ education savings plans like they were utility bills.

Speaking personally, I have two children, a 25-year-old, and a 12-year-old. There are a lot of lessons we learned when my oldest went to college and then grad school that my younger child will be able to benefit from. We waited to start saving for our oldest, and it cost us. He has some student loans as he started on his career that he has to work through because we didn’t start earlier.

You’ve given us a lot to think about! How would someone choose from these available options? What are some things to consider?

Paul: So, how do you choose which plan to use? Well, the good news is that veterans and active-duty personnel who qualify don’t have to. They can use any or all of them.

The GI Bill is a right. Service members earn it. They deserve it. So, they should definitely use it!

But augment it with other types of savings. Use the types of accounts that make sense for your specific situation. Try to estimate when and how much you’re going to need to send your loved ones to college. Then figure out how much you can save every month. Create a plan and stick to it.

Now, that is sometimes easier said than done. So, if you have questions and need help, you can use us as a resource to get answers.

It’s important to know that our plan (USAA 529 Education Savings Plan) was created for the military family. So, the odds are good that any questions you have we’ve probably heard them before. We are here to help.

Where would someone go for additional information and resources?

Derek: If you have additional questions, and would like to learn about our offerings, please reach out to us. Please contact us Monday through Friday at 1-844-844-2644 from 7:30 AM- 8 PM and we will be happy to speak to you and build a lasting relationship.