The Benefits of Using a VA Loan for Condo Purchases

by Rick Elmendorf - April 11th, 2022

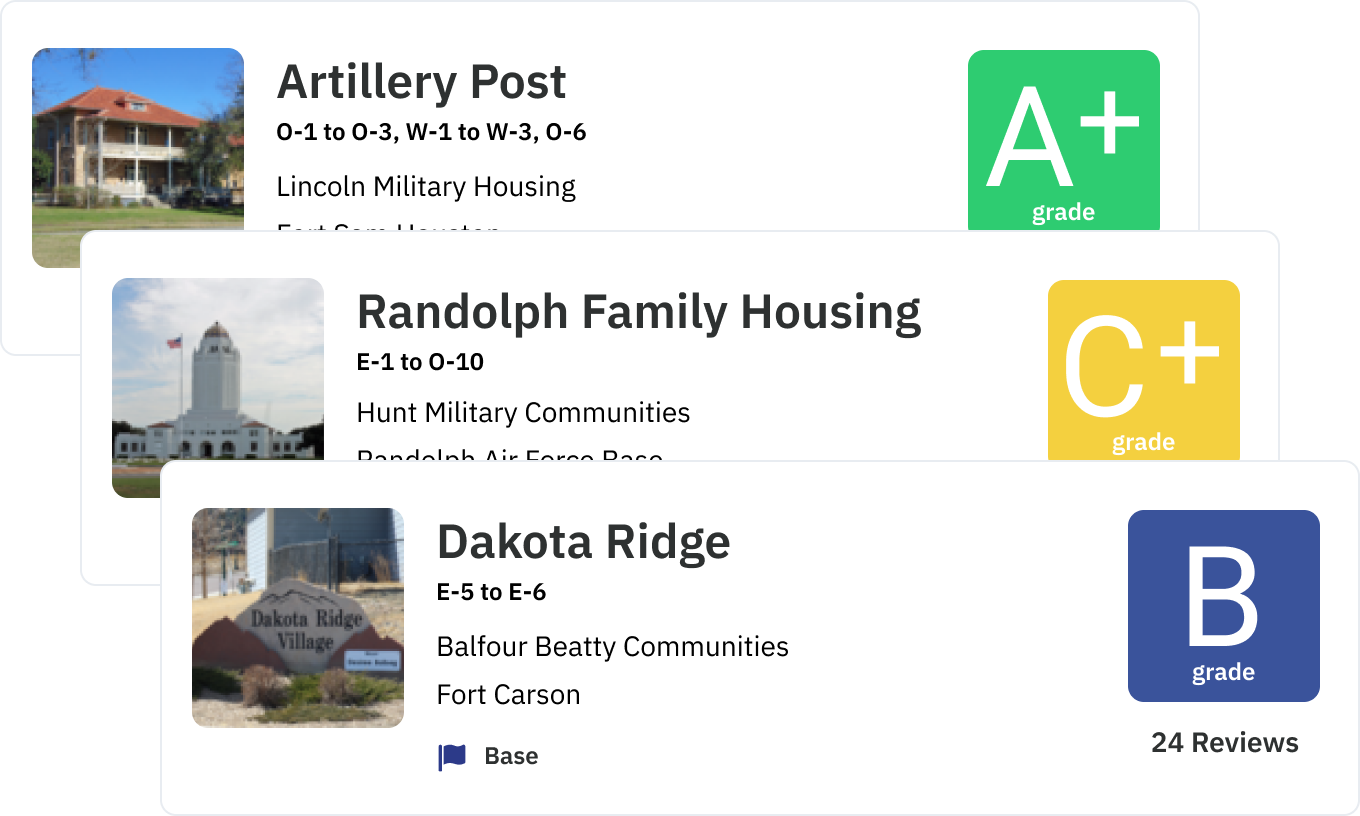

Condo living can provide a convenient and affordable alternative to renting or purchasing a single-family residence. If you're PCSing to a new location, buying a condo could be a viable option. Before committing to using your VA loan for condo ownership, there are a few factors to keep in mind.

Below are the pros and cons of condo ownership along with VA loan eligibility requirements and how you can purchase a condo using these benefits. Keep in mind that you can only use your VA benefits to purchase a VA-approved condo, which we discuss more in depth below.

1. Weigh the pros and cons of condo ownership

As you review your home buying options, it’s important to consider whether condo-style living matches your lifestyle as well as your ideal budget. Condos are often more affordable than single-family homes. They may also provide beneficial on-site amenities like fitness centers, outdoor recreational areas, and pools. In addition, they typically offer lower insurance rates than private residences and are often located in coveted downtown areas.

Many condos provide grounds and building maintenance, which are typically included in your monthly association fees. This on-site maintenance frees owners from the hassles and responsibilities associated with homeownership. On one hand, it makes condominiums ideal for those who deploy or those too busy or uninterested in maintaining their own properties. On the other hand, this upkeep may come at the cost of additional fees. Condo living may also require adherence to specific association rules and aesthetic standards.

As you choose between different condominiums, it’s also important to look into how the property is managed. Examine the condo association's budget and how that budget is allocated. Understanding the budget can help you gauge the association's level of responsiveness and its effectiveness in solving problems. In addition, it’s never a bad idea to meet some of your would-be neighbors and assess whether their lifestyles mesh with your own. It’s not realistic to be best friends with everyone in your condominium, but it’s important everyone is respectful, cooperative, and aligned on key association rules.

Connect with a military-friendly real estate agent who can help you find the ideal condominium.

2. VA loan condo approval standards

In order to use your VA benefits for condo purchases, the property must meet certain VA requirements. These standards are intended to protect your best interests. The requirements also ensure the condo association is a financially viable business and sound property investment.

To qualify as an approved property, a condominium must provide apt financial documentation and reserve a stipulated percentage of its budget for addressing maintenance issues. Furthermore, a certain percentage of the condominium must be occupied by owners (that is, not used primarily as rentals). All units must be fully insured against damages. Additionally, the majority of residents must have a low payment delinquency rate, among other criteria.

You can browse a list of VA-approved condos on the Department of Veteran Affairs website. You can also request information from the VA's database to get a better sense of how different properties compare. Condos that have been “accepted without conditions” are fully approved for mortgage financing. If a condo was HUD (Department of Housing and Urban Development) approved before December 2009, it may automatically qualify for VA mortgage financing without requiring additional VA approval.

Inquiring about the approval status of potential condo units will help you narrow down your search and determine the best course of action moving forward.

3. Review your VA loan eligibility

Along with looking into condo approval standards, don’t forget to consider your personal VA loan qualification criteria. Veterans must meet certain VA loan eligibility service requirements. You must purchase within VA loan limits, and not exceed a stipulated debt-to-income threshold.

VA loan eligibility also depends on standard loan approval practices, like maintaining a healthy credit score, paying bills on time, and avoiding large purchases or new lines of credit. Practicing smart credit usage and consulting a VA loan expert will help set you up for success.

The first step to VA loan approval is to connect with an experienced lender who can walk you through the VA loan process. Click here for a list of qualified loan experts.

4. What to do if the property isn't a VA-approved condo?

Not all condominiums will be listed in the VA’s database—but that doesn’t mean they don’t qualify. During your next military move, if a condo you’d like to purchase isn’t VA approved, you may want to encourage the association manager to apply for VA or HUD approval. If the condo is in good condition and meets all the baseline VA requirements for a home loan, the application will be approved. You’ll be eligible to use your VA benefits for the condo upon its approval.

Not all condo managers will be receptive to your requests to become VA-approved, however. If your requests aren’t being heard, it helps to have a VA loan expert on your side to advocate for VA condo approval and help you review your mortgage options.